Internet of Things (IoT) Testing Market by Testing Type (Functional, Performance, Network, Security, Compatibility, and Usability), Service Type (Professional and Managed), Application Type, and Region - Global Forecast to 2021

[127 Pages Report] The IoT testing market size is estimated to grow from USD 302.9 Million in 2016 to USD 1,378.5 Million by 2021, at a Compound Annual Growth Rate (CAGR) of 35.4% from 2016 to 2021.

The IoT testing market is gaining traction to show a significant increase in the overall growth rate of the market. The North American and European regions are in the growth phase, and the APAC region is in the early adoption stage. The MEA and Latin American regions are still in the introduction phase of the technology. The factors contributing to the high growth rate of the market in these regions are growing need for shift left testing of IoT applications and growing importance of microservices and DevOps. The need for IP testing of rising IoT devices is also driving the IoT testing market. However, dead apps and lack of consistency among standards for interconnectivity and interoperability are expected to restraint the market growth. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

IoT Testing Market Dynamics

Drivers

-

Microservices driving the development of enhanced IoT applications

-

Rising importance of DevOps

-

Need for IP testing of rising IoT devices

-

API monitoring is set to play a crucial role

-

Need for shift left testing of IoT

Restraints

-

Dead apps pose a formidable restraint to enterprises

-

Lack of consistency among standards for interconnectivity and interoperability

-

Shadow IT risk

Opportunities

-

Advent of software-defined application platform and controllers

-

Aligning management strategy with organizational strategic initiatives

-

Testing using service virtualization

Challenges

-

Test every possible input for every possible variable

-

Scalability of the IoT system and applications

-

Operational challenges such as real-time complexity, dynamic environment, and lack of compatibility and connectivity

-

Private data of individuals at risk

Microservices driving the development of enhanced IoT applications

Microservices is the emerging trends in enterprise applications, as they offer greater agility and operational efficiency for the enterprises in development and testing of IoT applications. Microservices provide a platform for developing enterprise applications including IoT, increase the productivity of applications at an astonishing rate, and help in the quick delivery of applications; thereby increasing the flexibility, reliability, availability, and scalability of the applications. Furthermore, it also helps to reduce time to market and shorten the SDLC of IoT applications. Microservices are majorly driven by the need for agility and speed and the re-composing of applications enabling experimentation and demands to support new delivery platforms such as the web, mobile web, native apps, and others. IoT applications supporting microservices are easier to deploy and offer distinct experiences for specific users, devices, or specialized use cases. So, testing of the microservices based on developed IoT applications is a crucial concern that needs to be addressed by the enterprises in order to boost the operational efficiency. In this scenario, IoT testing services play a vital role to address this concern, which helps to test and monitor complicated IoT applications. IoT testing service providers offers reliable and automated testing tools and solutions, in order to test the functionality, usability, performance, security, and compatibility of the IoT applications. The traditional monolithic applications are less reliable and scalable and are complex in nature. Therefore, many enterprises are adopting microservices for agile development of enterprise IoT applications to streamline their business operations.

The following are the major objectives of the study.

- To define, describe, and forecast the Internet of Things (IoT) testing market, on the basis of testing types, service types, application types, and regions

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To strategically analyze micro markets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market and details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- To analyze competitive developments such as mergers & acquisitions, new partnerships, and new product developments in the IoT testing market

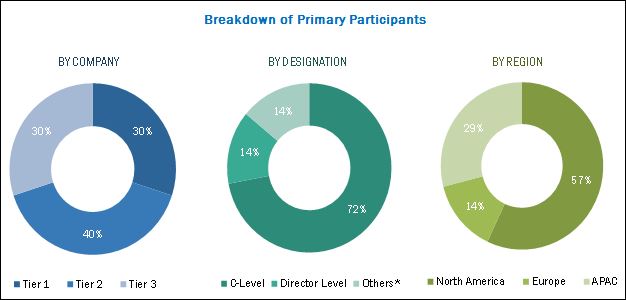

During this research study, major players operating in the global market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall IoT testing market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The IoT testing ecosystem comprises vendors providing IoT testing services and solutions to their commercial clients across globe. Companies such Cognizant (U.S.), Infosys (India), HCL Technologies (India), Capgemini (France), TCS (India), Happiest Minds Technologies (India), AFour Technologies (U.S.), SmartBear Software (U.S.), Rapid Value Solutions (U.S.), and Rapid7 (U.S.), and many others have adopted new partnerships, agreements, and collaborations as their key strategy to enhance their market reach. This strategy accounted for the largest share of the total strategies adopted by the market players.

IoT Testing Market Developments

- In January 2017, Rapid7 partnered with Coalfire, an industry-leading cyber risk management and compliance solution provider. This partnership enabled Rapid7 to deliver its PCI Approved Scanning Vendor (ASV) services. This partnership benefitted customers with the combined power of top-rated vulnerability management and compliance expertise.

- In May 2016, Capgemini also launched a digital manufacturing services to cater to its manufacturing clients for helping them with a reduction in the turnaround time and productivity gains by building smart connected plants & products, thereby enabling them to adopt new business models for the digital age.

- In December 2016, SmartBear Software partnered with Wipro, a global information technology, consulting, and outsourcing company. This partnership enabled SmartBear to provide a test readiness platform to its znterprise customers, expanding its addressable market.

Key Target Audience of IoT Testing Market

- IoT testing providers

- Quality assurance providers

- IoT platform providers

- IoT service providers

- Application providers

- Communication service providers

- Third-party system integrators

- Managed service providers

- Hardware vendors

- Regulatory agencies

- Governments

Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments.

Scope of the IoT Testing Market Research Report

The research report segments the global market into the following submarkets:

By Testing Type

- Functional Testing

- Performance Testing

- Network Testing

- Security Testing

- Compatibility Testing

- Usability Testing

IoT Testing Market Service Type

- Managed Services

- Professional Services

By Application Type:

- Smart Building and Home Automation

- Capillary Networks Management

- Smart Utilities

- Vehicle Telematics

- Smart Manufacturing

- Smart Healthcare

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North America market into the U.S. and Canada

- Further breakdown of the European market into U.K, Germany, and France

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the Internet of IoT testing market size to grow from USD 302.9 Million in 2016 to USD 1,378.5 Million by 2021, at a Compound Annual Growth Rate (CAGR) of 35.4%.

The IoT testing market is segmented on the basis of testing types, service types, and application types markets. The testing type segment is categorized into functional testing, performance testing, network testing, security testing, compatibility testing, and usability testing. Network testing holds the largest market share in the testing type segment, as network testing in IoT verifies the working and behavior of IoT applications with heterogeneous network connections and ensures synchronization of application with all different networking protocols to ensure seamless connectivity across the IoT platform. The service type segment is categorized into professional and managed services. The professional service type segment includes business consulting services, platform testing services, device field testing services, mobile application testing services, device & application management services, and training & support services. The application type segment is categorized into smart building & home automation, capillary networks management, smart utilities, vehicle telematics, smart manufacturing, and smart healthcare.

IoT is being adopted by different industries as a result of increasing daily business operations, new functionality for customers, and reduction in the expenses. The complex architecture of IoT systems and their unique characteristics make it mandatory to perform various types of testing across all system components. In order to ensure the scalability, performance, and security of IoT applications, the following types of testing are conducted: functional testing, performance testing, network testing, security testing, compatibility testing, and usability testing.

Functional testing of IoT devices includes the testing of interaction between devices, valid calculation, error handling, and basic device testing required for the performance of IoT application. Performance testing in IoT is carried out for performance validation of IoT devices and application performance, data transmit frequency between IoT device and application, multiple request handling carried out by smart devices, interrupt testing, and synchronization between IoT device & application. Network testing in IoT verifies the working and behavior of IoT applications with heterogeneous network connections and ensures synchronization of application with all different networking protocols to ensure seamless connectivity across the IoT platform. Security testing delivers comprehensive insights into security weaknesses present in infrastructures and IoT applications, which help to protect the IoT ecosystem from advanced persistent threats, zero-day attacks, and other cyber threats. In the IoT space, compatibility testing involves a comprehensive test of the various combinations of the sensors, applications, devices, platforms, and protocols. Usability testing refers to evaluating an IoT application with the respective user to identify any usability problem, collect the qualitative & quantitative data, and determine the user satisfaction of the application.

North America is expected to hold the largest market share and would dominate the IoT testing market from 2016 to 2021. This region has major dominance with sustainable and well-established economies, empowering them to strongly invest in research and development activities, thereby contributing to the development of new technologies such as IoT, big data, DevOps, and mobility. This adoption impacted the growth of testing services market extensively. Organizations are also keen to integrate IoT technologies in their processes, which boosted the growth of the IoT testing market significantly. Asia-Pacific (APAC) has witnessed advanced and dynamic adoption of new technologies and has always been a lucrative market.

IOT TESTING MARKET, BY REGION, 2021

IoT Testing Market : Application Type

Smart Building and Home Automation

Smart buildings comprise energy-saving equipment for the efficient functioning of all components and systems of a building, including lighting, monitoring, safety & security, emergency systems, heating, ventilation & air conditioning systems, and car parking. In smart buildings, connectivity testing is needed for testing communication between the infrastructure and the device, compatibility testing for the product & protocol versions, and security testing to tackle the data privacy and security concerns. Home automation is defined as the process of controlling and managing home appliances using IoT. Home automation systems use control systems and smart devices to control and manage basic home functions automatically over the internet, irrespective of any location.

Capillary network management

The capillary network management process involves management of a local network that uses short-range, radio-access technology to offer enhanced and reliable local internet connectivity to various things and smart devices. Capillary network is a smart way to get connectivity between things over the internet, by leveraging IoT services and solutions. It leverages key competences of cellular networks, including security, ubiquity, network management & automation, and backhaul connectivity to the global network communication infrastructure using capillary gateways. Capillary network management comprises tools and services for smart automatic configuration and management of capillary networks.

Smart Utilities

IoT is empowering the utility vertical by offering smart services such as smart grid for energy consumption, smart gas metering, and smart water metering. The smart utilities application manages the infrastructure that offers vital services to communities such as water, electricity, and gas. IoT components deployed in this system require reliable testing of smart sensors, components, and applications used for interconnection and communication. In this scenario, IoT testing services play a vital role in testing smart components and IoT applications, to offer superior quality experience and services to end users. Smart water metering gives consumers the capability to monitor their water consumption and other useful information. The smart water sensors track temperature, track water quality, and consumption. It is done with the help of software which analyzes the data and then returns to the consumer.

Vehicle Telematics

Vehicle telematics provides usage-based insurance services to the connected vehicles, which collects data from an IoT driver-installed sensor device to monitor the drivers performance and to set insurance policy charges based on the collected data from the device. Vehicle telematics is the technology of sending, receiving, and storing information related to vehicles via telecommunication objects. Vehicle telematics serves the purpose of providing safety related value added services such as remote vehicle tracking, recovery, and diagnostics, emergency services, and smart traffic management for reducing accidents. In vehicle telematics, fleet telematics helps to monitor the location, movement, status, and behavior of the vehicle within a fleet. This is achieved by GPS receiver and electronic GSM device installed in the vehicle, which communicates with the application.

Critical questions the report answers:

-

Where will all these application areas take the industry in the mid to long term?

-

What are the upcoming industry applications for IoT testing?

The IoT testing market is gaining traction due to the increasing adoption of smart devices & technologies; revolution & transformation of electronic products that are connected through the internet and adopted by different industries; increasing daily business operations; new functionality for customers; and reduction in the expenses. With increased outlook of demand side towards connecting their devices to obtain unified view of all the metrics involved to all stakeholders; making it a priority to perform in an efficient and cost effective way. The complex architecture of IoT systems and their unique characteristics makes it mandatory to perform various types of the test across all system components.

Key players in the IoT testing market include Cognizant (US), Infosys(India), Capgemini (France), TCS (India), Rapid7(US), Smartbear software (US), HCL (India), Happiest Minds Technologies (India), Rapidvalue solutions (US), Saksoft (India), Apica system (Sweden), Novacost (US) these players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Use Cases and Testing Coverage

2.1.2 Secondary Data

2.1.3 Primary Data

2.1.3.1 Breakdown of Primary Interviews

2.1.3.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the IoT Testing Market

4.2 Market: Top Three Growing Testing Type

4.3 Market, By Component and By Region, 2016

4.4 Market, By Region, 2016 vs 2021

4.5 Best Markets to Invest (20162021)

4.6 Lifecycle Analysis, By Region

5 IoT Testing Market Overview (Page No. - 30)

5.1 Market Segmentation

5.1.1 By Testing Type

5.1.2 By Service Type

5.1.3 By Professional Service Type

5.1.4 By Application Type

5.1.5 By Region

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Microservices Driving the Development of Enhanced IoT Applications

5.2.1.2 Rising Importance of Devops

5.2.1.3 Need for Ip Testing of Rising IoT Devices

5.2.1.4 API Monitoring is Set to Play A Crucial Role

5.2.1.5 Need for Shift Left Testing of IoT Applications

5.2.2 Restraints

5.2.2.1 Dead Apps Pose A Formidable Restraint to Enterprises

5.2.2.2 Shadow It Risk

5.2.2.3 Lack of Consistency Among Standards for Interconnectivity and Interoperability

5.2.3 Opportunities

5.2.3.1 Advent of Software-Defined Application Platform and Controllers

5.2.3.2 Aligning Management Strategy With Organizational Strategic Initiatives

5.2.3.3 Testing Using Service Virtualization

5.2.4 Challenges

5.2.4.1 Private Data of Individuals at Risk

5.2.4.2 Test Every Possible Input to Every Possible Variable

5.2.4.3 Scalability of the IoT System and Applications

5.2.4.4 Operational Challenges Such as Real-Time Complexity, Dynamic Environment, and Lack of Compatibility and Connectivity

6 IoT Testing Market: Industry Trends (Page No. - 40)

6.1 Introduction

6.2 System Architecture

6.3 Strategic Benchmarking

7 IoT Testing Market Analysis, By Testing Type (Page No. - 42)

7.1 Introduction

7.2 Functional Testing

7.3 Performance Testing

7.4 Network Testing

7.5 Security Testing

7.6 Compatibility Testing

7.7 Usability Testing

8 IoT Testing Market Analysis, By Service Type (Page No. - 51)

8.1 Introduction

8.2 Professional Services

8.2.1 Business Consulting Services

8.2.2 Platform Testing Services

8.2.3 Device Field Testing Services

8.2.4 Mobile Application Testing Services

8.2.5 Device and Application Management Services

8.2.6 Training and Support Services

8.3 Managed Services

9 IoT Testing Market Analysis, By Application Type (Page No. - 62)

9.1 Introduction

9.2 Smart Building and Home Automation

9.3 Capillary Networks Management

9.4 Smart Utilities

9.5 Vehicle Telematics

9.6 Smart Manufacturing

9.7 Smart Healthcare

10 Geographic Analysis (Page No. - 71)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Company Profiles (Page No. - 90)

11.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.2 Cognizant Technology Solutions Corporation

11.3 Infosys Limited

11.4 Capgemini S.A.

11.5 Rapid7 Inc.

11.6 Smartbear Software

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12 IoT Testing Market Key Innovators (Page No. - 104)

12.1 Tata Consultancy Services

12.1.1 Business Overview

12.2 HCL Technologies Ltd.

12.2.1 Business Overview

12.3 Happiest Minds Technologies

12.3.1 Business Overview

12.4 Rapidvalue Solutions

12.4.1 Business Overview

12.5 Saksoft Limited

12.5.1 Business Overview

12.6 Apica System

12.6.1 Business Overview

12.7 Novacoast, Inc.

12.7.1 Business Overview

12.8 Trustwave Holdings

12.8.1 Business Overview

12.9 Ixia

12.9.1 Bussiness Overview

12.10 Beyond Security

12.10.1 Business Overview

12.11 Afour Technologies Pvt Ltd

12.11.1 Business Overview

12.12 Praetorian

12.12.1 Business Overview

13 Appendix (Page No. - 117)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (46 Tables)

Table 1 IoT Testing Market Size and Growth Rate, (USD Million, Y-O-Y %)

Table 2 Market Size, By Testing Type, 20162021 (USD Million)

Table 3 Functional Testing: Market Size, By Region, 20162021 (USD Million)

Table 4 Performance Testing: Market Size, By Region, 20162021 (USD Million)

Table 5 Network Testing: IoT Testing Market Size, By Region, 20162021 (USD Million)

Table 6 Security Testing: Market Size, By Region, 20162021 (USD Million)

Table 7 Compatibility Testing: Market Size, By Region, 20162021 (USD Million)

Table 8 Usability Testing: Market Size, By Region, 20162021 (USD Million)

Table 9 Market Size, By Service Type, 20162021 (USD Million)

Table 10 IoT Testing Market Size, By Professional Service Type, 20162021 (USD Million)

Table 11 Professional Services: Market Size, By Region, 20162021 (USD Million)

Table 12 Business Consulting Services: Market Size, By Region, 20162021 (USD Million)

Table 13 Platform Testing Services: Market Size, By Region, 20162021 (USD Million)

Table 14 Device Field Testing Services: IoT Testing Market Size, By Region, 20162021 (USD Million)

Table 15 Mobile Application Testing Services: Market Size, By Region, 20162021 (USD Million)

Table 16 Device and Application Management Services: Market Size, By Region, 20162021 (USD Million)

Table 17 Training and Support Services: Market Size, By Region, 20162021 (USD Million)

Table 18 Managed Services: Market Size, By Region, 20162021 (USD Million)

Table 19 IoT Testing Market Size, By Application Type, 20162021 (USD Million)

Table 20 Smart Building and Home Automation: Market Size, By Region, 20162021 (USD Million)

Table 21 Capillary Networks Management: Market Size, By Region, 20162021 (USD Million)

Table 22 Smart Utilities: Market Size, By Region, 20162021 (USD Million)

Table 23 Vehicle Telematics: Market Size, By Region, 20162021 (USD Million)

Table 24 Smart Manufacturing: Market Size, By Region, 20162021 (USD Million)

Table 25 Smart Healthcare: Market Size, By Region, 20162021 (USD Million)

Table 26 IoT Testing Market Size, By Region, 20162021 (USD Million)

Table 27 North America: Market Size, By Testing Type, 20162021 (USD Million)

Table 28 North America: Market Size, By Service Type, 20162021 (USD Million)

Table 29 North America: Market Size, By Professional Service Type, 20162021 (USD Million)

Table 30 North America: Market Size, By Application Type, 20162021 (USD Million)

Table 31 Europe: IoT Testing Market Size, By Testing Type, 20162021 (USD Million)

Table 32 Europe: Market Size, By Service Type, 20162021 (USD Million)

Table 33 Europe: Market Size, By Professional Service Type, 20162021 (USD Million)

Table 34 Europe: Market Size, By Application Type, 20162021 (USD Million)

Table 35 Asia-Pacific: IoT Testing Market Size, By Testing Type, 20162021 (USD Million)

Table 36 Asia-Pacific: Market Size, By Service Type, 20162021 (USD Million)

Table 37 Asia-Pacific: Market Size, By Professional Service Type, 20162021 (USD Million)

Table 38 Asia-Pacific: Market Size, By Application Type, 20162021 (USD Million)

Table 39 Middle East and Africa: IoT Testing Market Size, By Testing Type, 20162021 (USD Million)

Table 40 Middle East and Africa: Market Size, By Service Type, 20162021 (USD Million)

Table 41 Middle East and Africa: Market Size, By Professional Service Type, 20162021 (USD Million)

Table 42 Middle East and Africa: Market Size, By Application Type, 20162021 (USD Million)

Table 43 Latin America: IoT Testing Market Size, By Testing Type, 20162021 (USD Million)

Table 44 Latin America: Market Size, By Service Type, 20162021 (USD Million)

Table 45 Latin America: Market Size, By Professional Service Type, 20162021 (USD Million)

Table 46 Latin America: Market Size, By Application Type, 20162021 (USD Million)

List of Figures (46 Figures)

Figure 1 IoT Testing Market Segmentation

Figure 2 IoT Testing Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 IoT Testing Type Market Snapshot: Network Testing is Expected to Dominate the Market (20162021)

Figure 7 IoT Testing Market Regional Snapshot: North American Market is Expected to Grow Fourfold During the Forecast Period

Figure 8 North America is Estimated to Hold the Largest Market Share in 2016

Figure 9 Growing Need for Shift Left Testing of IoT Applications and Rising Importance of Microservices & Devops is Driving the IoT Testing Market

Figure 10 Network Testing, Compatibility Testing, and Usability Testing Types are Expected to Grow at an Impressive Rates During the Forecast Period

Figure 11 Network Testing is Expected to Hold the Largest Market Share in the IoT Testing Market During the Forecast Period

Figure 12 North America is Expected to Hold the Largest Market Size During the Forecast Period

Figure 13 Asia-Pacific is Considered to Be the Best Market to Invest in During the Forecast Period

Figure 14 Regional Lifecycle

Figure 15 IoT Testing Market: Market Segmentation

Figure 16 Market Segmentation: By Testing Type

Figure 17 Market Segmentation: By Service Type

Figure 18 IoT Testing Market Segmentation: By Professional Service Type

Figure 19 Market Segmentation: By Application Type

Figure 20 Market Segmentation: By Region

Figure 21 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 IoT Testing Market: System Architecture

Figure 23 Strategic Benchmarking: Agreements, Partnerships, and Collaborations

Figure 24 Network Testing Segment is Expected to Lead the IoT Testing Market During the Forecast Period

Figure 25 North America is Expected to Lead in the Market for Network Testing During the Forecast Period

Figure 26 Asia-Pacific is Expected to Grow at A Rapid Pace During the Forecast Period

Figure 27 Managed Services Segment is Expected to Grow at A Higher CAGR Compared to Professional Services in the IoT Testing Market During the Forecast Period

Figure 28 Device Field Testing Professional Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 North America is Expected to Dominate the Mobile Application Testing Services Segment in the Market During the Forecast Period

Figure 30 North America is Expected to Dominate the Device and Application Management Services Segment in the IoT Testing Market During the Forecast Period

Figure 31 North America is Expected to Dominate the Managed Services Segment in the IoT Testing Market During the Forecast Period

Figure 32 Smart Manufacturing Segment is Expected to Dominate the IoT Testing Market During the Forecast Period

Figure 33 Asia-Pacific is Expected to Grow at the Highest CAGR in Vehicle Telematics Segment During the Forecast Period

Figure 34 North America is Expected to Dominate the Smart Manufacturing Application During the Forecast Period

Figure 35 North America is Expected to Exhibit the Largest Market Size in the IoT Testing Market During the Forecast Period

Figure 36 Regional Snapshot: Middle East & Africa and Latin America are Emerging as New Hotspots

Figure 37 Network Testing is Expected to Have the Largest Market Size in North America During the Forecast Period

Figure 38 Vehicle Telematics is Expected to Grow at the Highest CAGR in North America During the Forecast Period

Figure 39 North America Market Snapshot

Figure 40 Network Testing is Expected to Have the Largest Market Size in Asia-Pacific During the Forecast Period

Figure 41 Vehicle Telematics is Expected to Grow at the Highest CAGR in Asia-Pacific During the Forecast Period

Figure 42 Asia-Pacific Market Snapshot

Figure 43 Cognizant Technology Solutions Corporation: Company Snapshot

Figure 44 Infosys Limited: Company Snapshot

Figure 45 Capgemini S.A.: Company Snapshot

Figure 46 Rapid7 Inc.: Company Snapshot

Growth opportunities and latent adjacency in Internet of Things (IoT) Testing Market